Introducing the Get Started Wizard

How fast can you set up an enterprise AI Agent? With the Get Started Wizard, the answer is: just minutes. Our newest platform feature makes it simple to spin up a foundation of topics tailored to your industry, build an initial knowledge base automatically, and activate guardrails for safe, compliant conversations. No lengthy setup. No complex configuration. Just a solid foundation—built in.

Book a meeting with Fernando

Resources

-

Thursday, October 2, 2025 Boost.ai

Trends, insights and prediction for conversational AI in 2025 - and beyond

The rapid push to adopt AI has created “hyperfatigue” and a critical demand for measurable ROI. This guide – complete with trends, insights and predictions from industry experts – provides a clear roadmap to move from AI exploration to strategic validation. -

Thursday, September 25, 2025 Boost.ai

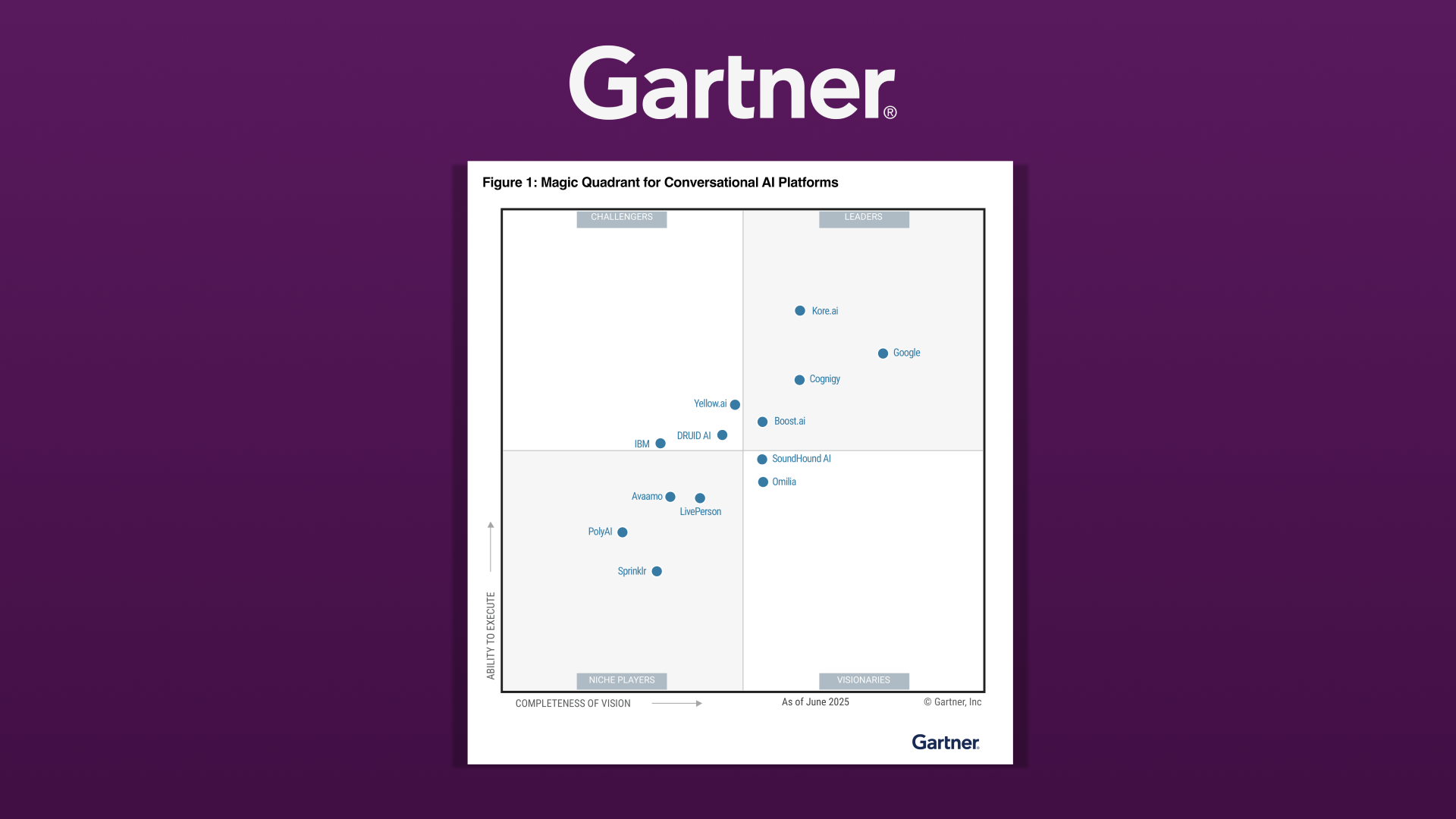

Gartner® Magic Quadrant™ for Conversational AI Platforms

This evaluation provides a comprehensive overview of the conversational AI market, helping businesses choose the platform that aligns with their requirements. -

Thursday, May 8, 2025 Boost.ai

A Buyer’s Guide to Conversational AI

Your guide to choosing the right conversational AI platform. Know what to look for. Know what to ask. Avoid the common mistakes.

About Boost.ai

Boost.ai empowers leading credit unions to automate member service and internal support - delivering on the promise of conversational AI at scale. We help our customers drive up member satisfaction while cutting operational costs and streamlining efficiencies. When your members have access to highly intelligent self-service tools, human agents can do more of what they do best – answer complex inquiries that can only be solved with human help. When self-service efficiency increases, waiting times decrease, and customer satisfaction skyrockets! Built on a market-leading technology stack that includes proprietary Natural Language Understanding (NLU) algorithms, the boost.ai platform enables the development of broad-scope virtual agents to cover a wide range of topics (10,000+ intents), with a deep level of knowledge, while maintaining 90%+ resolution rates. Consistent, 24/7 support with quickly resolved questions = happy members. This accuracy at scale is the key component to creating value from conversational AI and ensuring that enterprises using our solution can successfully improve customer satisfaction, cut costs and increase revenues. Boost.ai virtual agents free up valuable time for contact center teams. But what about the remaining 10%? Boost.ai’s proprietary Automatic Semantic Understanding (ASU) technology helps eliminate false positives and intelligently transfer customers to the correct live agent when needed. Plus, thanks to self-learning AI and pre-built industry-specific content for credit unions, you can be up and running in weeks. In fact, 85% of our customers reach a positive ROI within 3 months.

Contact Us

Complete the form and we will get back to you as soon as possible.